How does the 0% for 12 months offer work?

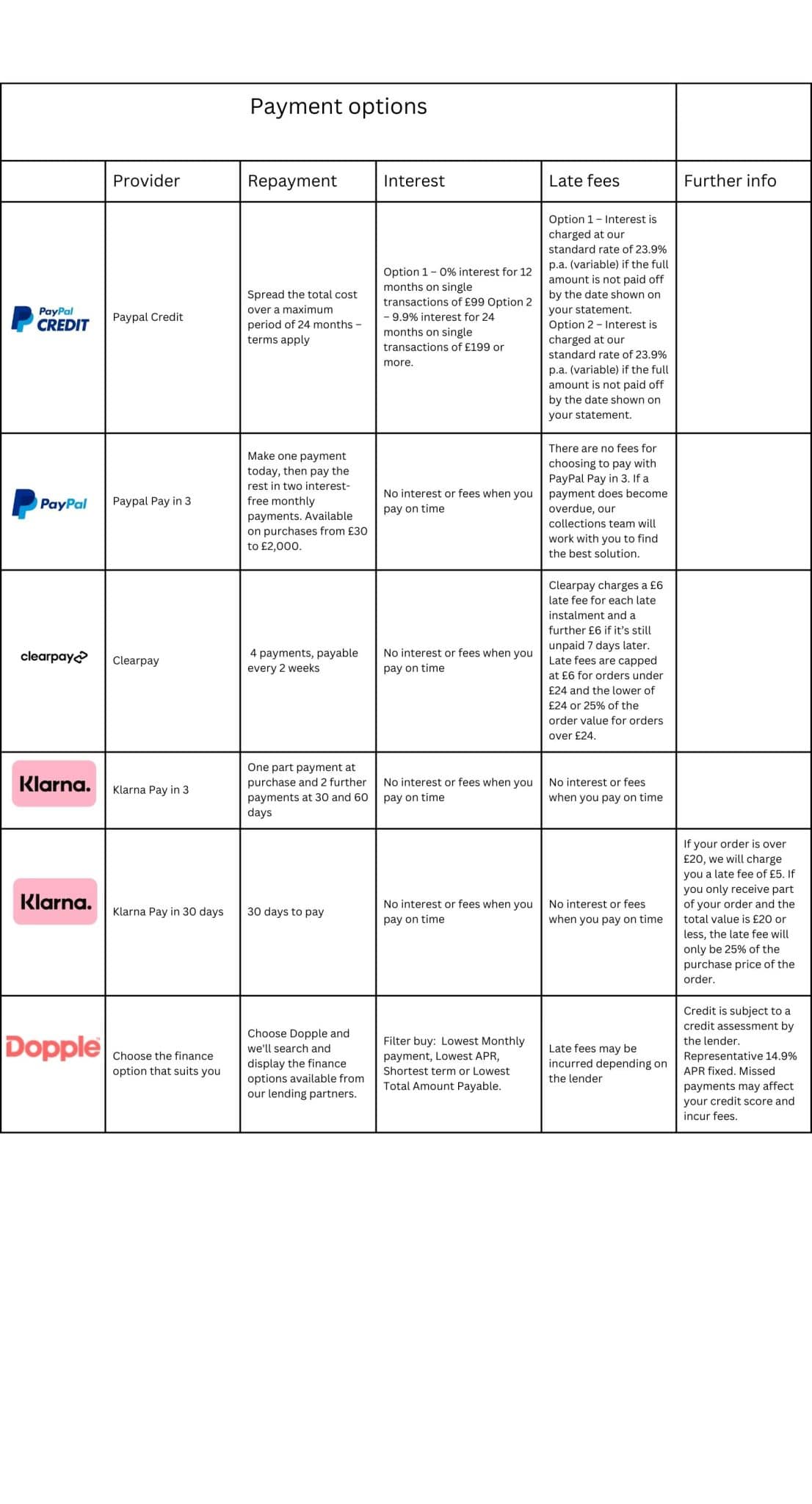

For customers with PayPal Credit, 0% interest for 12 months is available on single transactions of £99.00 or more. This means when you spend more than £99.00 in one shopping basket, you’ll benefit from the offer and won’t be charged any interest on that transaction for 12 months after purchase. This applies automatically to any purchase made using PayPal Credit in excess of this value, except those to which another promotional offer (such as an instalment offer) applies. You can use this offer as many times as you like as long as you have an available credit limit.

While no interest is charged, any balance subject to a 0% for 12 months offer will be included in the calculation of your minimum repayment amount. Any remaining balance due after the 12-month promotional period will be charged at 23.9% p.a. (variable). If you fail to make minimum repayments on time or in certain other circumstances, PayPal may remove your offer. Please see the Credit Agreement for more details.

How do instalment offers with PayPal Credit work?

With selected merchants, when you check out with PayPal Credit, you’ll be shown a selection of instalment offers which enable you to spread the cost of your purchase across a number of repayments. These instalment offers allow you to choose a set monthly repayment over a fixed period to help spread the cost of larger purchases in a more manageable way.

Instalment offers will always have an interest rate lower than the standard variable rate. If you already have PayPal Credit, you can take advantage of these offers without having to reapply as long as you have enough available credit limit.

It is important that you think about whether you can afford the monthly repayment agreed for any instalment offer. This will be added to your monthly minimum repayment amount and will need to be paid each month.

If you fail to make repayments or in certain other circumstances, PayPal may remove your offer and any outstanding amount will be charged at 23.9% p.a.

(variable). Please see the Credit Agreement for more details.

© 2022 PayPal Inc. Confidential and proprietary.

FAQ – PayPal Credit

What Is PayPal Credit?

PayPal Credit is like a credit card, without the plastic. It’s a credit limit that’s attached to your PayPal account which you can use for your online purchases. If you have PayPal Credit it will be available as a funding source within your PayPal wallet and can be used for purchases in most places where PayPal is accepted. You can make purchases in the same way as you would with a normal credit card, by choosing PayPal Credit as your funding source at checkout.

For purchases less than £99.00, interest is charged at our standard rate of 23.9% p.a. (variable) if the full amount is not paid off by the date shown on your statement. In addition, PayPal Credit lets you access two types of promotional offers: 0% for 6 or 12 months on all purchases of £99.00 and over; pay over 18 or 24mths with an interest rate of 9.9%

Is PayPal Credit Available To Everyone?

No, PayPal Credit is only available to customers over 18 living in the United Kingdom (excluding Channel Islands and the Isle of Man). PayPal also have to assess a customer’s creditworthiness, so you should have a good credit history to apply.

How Can I Apply For PayPal Credit?

Customers may be offered the opportunity to apply for credit on a website, if purchasing an eligible product and choosing to apply for an instalment offer using PayPal Credit. Otherwise customers can apply directly via PayPal’s website.

Click here to see the full FAQ for PayPal Credit and view the Terms and Conditions.

© 2022 PayPal Inc. Confidential and proprietary.

FAQ – PayPal Pay in 3

Pay in 3

Make one payment today, then pay the rest in two interest-free monthly payments. Available on purchases from £30 to £2,000. Apply easily and get an instant decision. Check out securely with PayPal and choose Pay in 3

Subject to status. Terms and Conditions apply. UK residents only. PayPal is a responsible lender. Pay in 3 performance may influence your credit score. PayPal Pay in 3 is a trading name of PayPal UK Ltd, Whittaker House, Whittaker Avenue, Richmond-Upon-Thames, Surrey, United Kingdom, TW9 1EH

Click here to learn more about Pay in 3.

© 2022 PayPal Inc. Confidential and proprietary.